does michigan have a inheritance tax

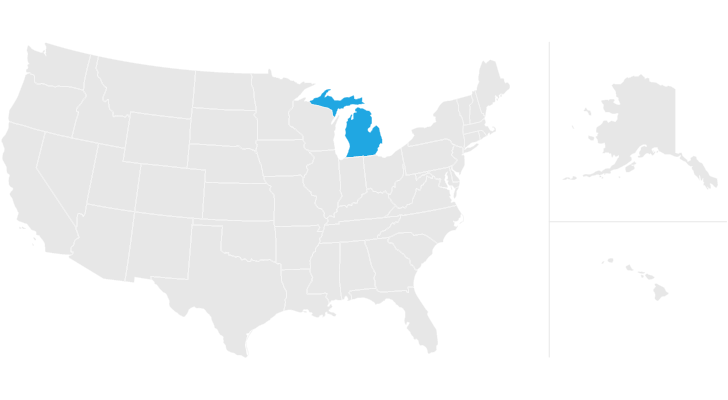

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Michigan does not have an inheritance or estate tax but your estate will be subject to the Wolverine States inheritance laws.

How To Avoid Estate Taxes With A Trust

This nil-rate IHT band is transferable to a spouse or civil partner on death resulting in a total nil-rate band of 650000 for couples.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. In this detailed guide of Michigan inheritance laws we break down state laws concerning intestate succession probate taxes what makes a. Many people have dreamed of finding out they have a distant relative who leaves them an inheritance when they die. They may have even made plans for how they would use that money to make life better if it did exist.

Inheritance tax is not a death tax inheritance tax is a transfer tax it a gift tax so if you give away too much away to a business or to a trust you may end up paying inheritance tax today while still alive but if you give money family and friends you can give away as much as you want and provided you survive for 7 years no problem but if you die within 7 years it will be. A legal document is drawn and signed by the heir waiving rights to. The Michigan Department of Treasury does not administer the federal stimulus program or have any information regarding federal stimulus payments.

Is Social Security taxable in Michigan. Social Security payments are not taxed in Michigan. Michigan does not have an estate tax or an inheritance tax.

Its no wonder that when they receive an email suggesting such a thing they want to believe it. In the tax year 202122 the inheritance tax nil-rate band also known as the inheritance tax threshold for individuals is 325000 and it will remain at this level until 2026. Any Social Security retirement income that is considered taxable on your federal income tax return can be subtracted from your Adjusted Gross Income.

The Internal Revenue Service administers this program and encourages taxpayers to visit wwwIRSgov for the most current information on the second round of federal stimulus payments including checking the status of a payment. Delaware doesnt have a sales tax but it does impose a gross receipts tax on businesses. Delawares gross receipts tax is a percentage of total receipts from goods sold and services rendered within the state and it ranges from 00945 to 07468 as of February 2022.

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

How To Avoid Estate Taxes With A Trust

States With An Inheritance Tax Recently Updated For 2020

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

State Estate And Inheritance Taxes Itep

Recent Changes To Estate Tax Law What S New For 2019

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Is There An Inheritance Tax In Michigan Axis Estate Planning

Seeking Advice On Inheritance Taxes R Japanlife

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die